I consider this a successful year for both my trading and my blog's growth. I'm getting a pretty steady stream of 100 hits a day which is much better than the 20 a year ago. On other fronts, I was turned down about 25 times by different companies for jobs. Guess what? This outsider is going to keep doing it while only spending about 35 minutes a day at the computer during trading hours to make decisions.

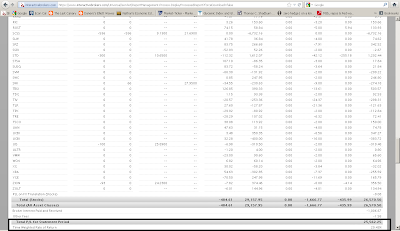

For people who think I'm here to push an agenda while making money off of ads, please see the below picture for how much I've earned from ads since this blog started. I don't really know why I'm here because it is not worth it, but I enjoy the opportunity to have somewhat of a voice while having an actual log of successful calls and failures. Maybe I just keep hoping "someone out there will find me" to use the words of Green Day.

In the interest of full disclosure, I decided to report my Jan 3 - Dec 30 2011 trading history. Find another site that will do that. There are some serious bruises.

After four long years of many frustrations and a bad 2008 (the only non-profitable year), I handily beat the market in 2011 (20% versus flat) without fancy research reports and using only a few tools. Granted, this is probably considered a small account to most of you.

Here it is:

I drew black or red lines around massive losses that I incurred. Most are not realized because I'm stubborn - BBX, CHRS, CPF, MTG, OGXI, SCSS - a total of $14692 - or another ~15% that could have been added to the bottom line . Maybe they will keep getting bigger and will wipe out all of this year's wins. Who knows? I still believe we are in a long term (decades) bear market, and that is why I haven't closed them.

BBX is the only one that is not the result of bad money management. It gapped up and went up 300% the day after I opened the position. I held it (told you I didn't have emotions) and now the loss is about 50%. Much better. The rest I had plenty of opportunities to limit to the losses to about 400 bucks.

A lot of traders tell you to focus on the big wins - having a high slugging percentage and cutting losers. I still agree with that, but in a sideways year it is harder to get the big winners. My 2011 history shows a solid batting average and consistency that was able to overcome massive losses and still show a profit. I am not proud of the losses, but its a learning point for you and me about how important money management is.

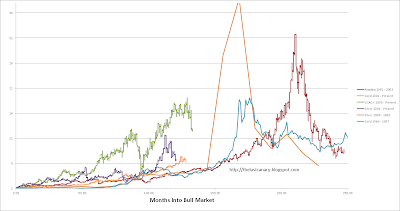

Since it is the end of the year, I also wanted to update some of the charts. Here is Gold versus USAGX, Silver, Nasdaq, and the 70s bull markets.

Source: Various. gold.org / yahoo finance.

Gold still seems to resemble several parts of the Nasdaq bull market.

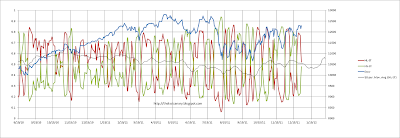

Energy consumption for the US.

Source: http://www.eia.gov/ The economic recovery story doesn't seem to surface here.

I would guess earnings can easily be higher now that debt issuance (& inflation) has largely taken the place of taxation for government spending.

People keep saying bond yields will rise in the US soon. Looks like it took about 50 years for yields to get back to where they were in 1921. Just saying.

Source: Shiller data. Dividend yield still doesn't say "buy." In fact, it is not even close. Now you know why I stay short on a mattress company.

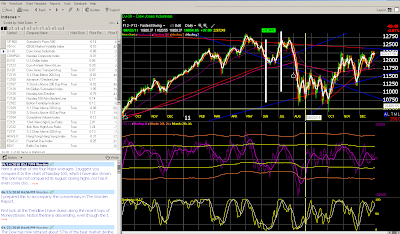

I marked the three dates above to correspond with the below posts. Yes, my posts are wishy-washy, but that is because I know I don't know. I just go with the odds - sorry if I don't lead you more to the water. Oversold to me means buy most of the time, and overbought means sell most of the time. I don't need to put more than that. As for the first half of 2011, as most of you know I am better at calling bottoms than tops.

And I can't find them for whatever reason, but don't forget my posting about how silly it was to be buying silver in April as it hit its 3rd standard deviation. Or the targets I set 2.5 months ago for silver of 21 - 25 and gold of 1420. I was junked hard on Zerohedge for both of those predictions...

"The test of a first-rate intelligence is the ability to hold two opposed ideas in the mind at the same time and still retain the ability to function. One should, for example, be able to see that things are hopeless and yet be determined to make them otherwise."

F. Scott Fitzgerald

I get a lot of my quotes from nowandfutures.com - check out their site. Lots of great information.